Artificial Intelligence Applied with Ingenuity for Your Profitability.

"If we were motivated by money, we would have sold the company a long time ago and ended up on a beach."

Compound Annual Growth Rate.

What is Cassandra?

Cassandra is a Machine Learning-based information system with broad applications, currently focused on predicting the price of Bitcoin to assist in investment decisions.

Investment notices +

Market intelligence

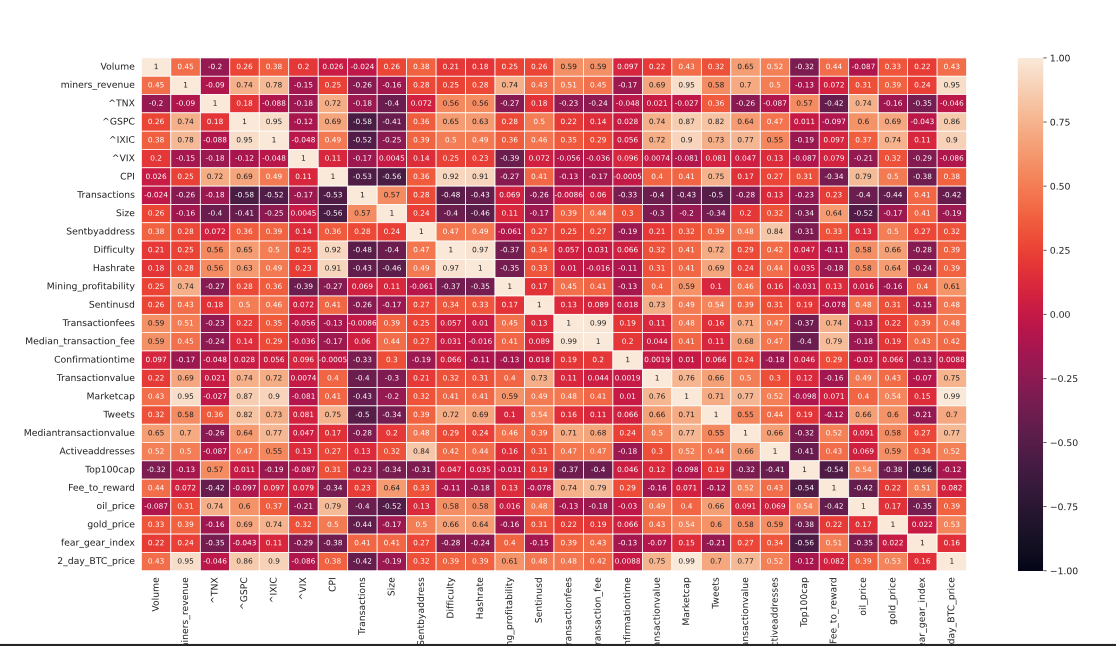

BTC price increase or decrease forecast notifications. Net positions of major indices and cryptocurrencies. Correlation charts of BTC price with 27 critical variables.

What's Next

How does it work?

1. Cassandra analyzes historical data (3 years) from BTC and other sources to explain trends.

2. It looks for relationships between data without predefined bias, drawing quantitative conclusions.

3. Generates profitable investment assumptions and target value predictions.

4. It then tests the hypotheses, confirming their fit to reality with future values, and generating new hypotheses with variations, until the optimal risk prediction is reached.

Support for your financial investments

Check here our service

Are you a professional investor?

Let´s talk. We are looking forward to doing things, maybe with you.

Signals Service

Cassandra anticipates when Bitcoin is trending up or down, and alerts us with signals to help you decide.

It's not Magic. It is Technology, Mathematics, and computer skills.

Automated multivariable analysis

Adaptation and continuous optimization

Pattern and trend forecasts

Risk minimization

Elimination of human bias

24/7 operation

Development Phases

-

Decision support system

-

Next day BTC trend indicator

-

Trend filter for intraday strategies

-

Support by mail

-

Without permanence

-

Substitutes the user in the decision making process

-

BTC Buy/Sell Alert

-

Entry price range

-

Value for Take Profit

-

Price for Stoploss

-

App Cassandra

-

Main cryptoassets

-

Main indexes

-

New assets and markets to follow

-

Assets with high trading volume

-

Adaptation to partner needs

Market Intelligence

Information about the financial market in general and specific statistical data about Bitcoin, to help you in the analysis of your investments.

Net Position Report

Each graph represents for each of the financial indexes indicated, the evolution and state of the net value between open long positions (buying) and open short positions (selling), indicating the prevalence for all investors of the growth or decline assumptions of that index or asset.

Last update: 27-06-2025.

BTC Correlations Report

Each graph represents the evolution of the percentage variation of each of the variables indicated, with respect to the variation of 1% in the price of BTC, reflecting the correlation (negative or positive) between both data.

Last update: 27-06-2025.

Why

■ The relationship between humans and technology is increasingly close and interdependent. Such technology has become an integral part of our lives, and its presence impacts a wide variety of areas, from home and work to industry and scientific research.

■ Technology has enabled us humans to automate repetitive and tedious tasks, and has also provided access to an unprecedented amount of information and resources, enabling the creation of innovative technologies that improve our quality of life.

■ Overall, the relationship between humans and technology is complex and multifaceted, and is constantly evolving as new methodologies are developed and new challenges are addressed. It is important that we continue to reflect and work together to ensure that this relationship is beneficial to all and that we can harness the full potential to improve our lives and our world.

■ Artificial Intelligence (AI) is rapidly transforming the way we live, work and interact with each other. In the long term, AI is likely to have a significant impact on the way humans live, both positively and negatively.

■ On the positive side, AI could improve efficiency and productivity in a wide range of industries, which could lead to a higher quality of life for many people. AI could also be used to solve global problems, such as poverty, climate change and disease.

■ However, AI also poses significant risks in the long term. For example, AI could have a negative impact on employment, as jobs that were previously performed by humans could be automated by intelligent machines. This could lead to greater economic and social inequality unless steps are taken to address these concerns.

■ In addition, AI could also have an impact on the privacy and security of individuals, as intelligent machines could collect and analyze large amounts of personal data. This could lead to privacy and security issues unless measures are taken to protect individual rights and freedoms.

■ Artificial Intelligence (AI) can improve the efficiency, accuracy and speed of financial operations, which can lead to higher profits and reduced risks.

■ It can also be used for data analysis and pattern identification, which can enable investors and traders to make more informed decisions. Machine learning techniques can be used to analyze large amounts of financial data and predict trends and changes in the market. AI can also be used for portfolio management and automated investment decision making.

■ This allows us to react more quickly to changes in the market and take advantage of investment opportunities. AI can also be used for the development of advanced trading algorithms that can analyze real-time data and automatically adjust trading strategies in response to changes in the market.

■ Human emotions have a significant impact on the performance and investment decisions of retail investors. They can often be driven by emotions such as fear, greed, euphoria and panic, which can lead to irrational or impulsive investment decisions that can negatively affect their investment returns.

■ For example, when financial markets experience high volatility, such as during a financial crisis, many retail investors may become fearful and panic, which may lead them to sell their investments at an inopportune time, thus losing the opportunity to recover their investment in the long term.

■ Similarly, when financial markets experience a sharp rise in prices, many retail investors may become euphoric and overvalue asset prices, which can lead them to invest in overvalued assets and eventually suffer losses.

■ In addition, greed can lead retail investors to take greater risks than would be prudent in an effort to earn higher returns. This can lead to uninformed investment decisions and taking overly large positions in risky assets.

■ Artificial intelligence (AI) helps to reduce or eliminate the influence of human emotionality on investment processes in financial markets through several approaches:

- Predictive models: AI can build predictive models that use machine learning techniques to predict the performance of financial assets. This allows investors to make informed, data-driven decisions, reducing the influence of emotions in the investment process.

- Algorithmic trading: AI can be used to build automated trading systems that operate objectively and without human intervention. These systems can follow a predefined strategy and make investment decisions based solely on financial data, which significantly reduces the influence of human emotionality in the investment process.

- Market sentiment analysis: AI can analyze and process large amounts of unstructured data, such as news, opinions and social networks, to detect market sentiment and investor mood. This allows investors to make more informed and objective decisions based on data rather than emotions.

■ In short, AI can help remove human emotionality from investment processes in financial markets through data analysis, predictive modeling, algorithmic trading and market sentiment analysis.

FAQ

Cassandra is a Machine Learning-based information system that uses advanced algorithms and historical data analysis to predict values of different time series. The system is currently programmed to predict future trends in the value and price of Bitcoin, and will soon do so for other financial assets. It therefore currently combines real-time data with machine learning techniques to generate predictions and provide investment decision support.

Cassandra es un sistema de información basado en Inteligencia Artificial (Machine Learning) que utiliza algoritmos avanzados y análisis de datos históricos para predecir valores de distintas series temporales. Actualmente el sistema está programado para predecir tendencias futuras en el valor y precio de Bitcoin, y próximamente lo hará para otros activos financieros. Por tanto actualmente combina datos en tiempo real con técnicas de machine learning para generar predicciones y proporcionar apoyo en la toma de decisiones de inversión.

Cassandra es un sistema de información basado en Inteligencia Artificial (Machine Learning) que utiliza algoritmos avanzados y análisis de datos históricos para predecir valores de distintas series temporales. Actualmente el sistema está programado para predecir tendencias futuras en el valor y precio de Bitcoin, y próximamente lo hará para otros activos financieros. Por tanto actualmente combina datos en tiempo real con técnicas de machine learning para generar predicciones y proporcionar apoyo en la toma de decisiones de inversión.

Cassandra es un sistema de información basado en Inteligencia Artificial (Machine Learning) que utiliza algoritmos avanzados y análisis de datos históricos para predecir valores de distintas series temporales. Actualmente el sistema está programado para predecir tendencias futuras en el valor y precio de Bitcoin, y próximamente lo hará para otros activos financieros. Por tanto actualmente combina datos en tiempo real con técnicas de machine learning para generar predicciones y proporcionar apoyo en la toma de decisiones de inversión.

Cassandra is a Machine Learning-based information system that uses advanced algorithms and historical data analysis to predict values of different time series. The system is currently programmed to predict future trends in the value and price of Bitcoin, and will soon do so for other financial assets. It therefore currently combines real-time data with machine learning techniques to generate predictions and provide investment decision support.

Cassandra collects data from a variety of sources, including historical price information, trading volumes, financial news and relevant market events. This data is used to train machine learning models and improve the accuracy of predictions.

Cassandra can have a multitude of applications, from industrial processes to aspects of human behaviour, across a very broad spectrum of possibilities. The Cassandra team is currently in discussions with partners in various fields to explore the next most valuable use case.

The performance of an investment will vary depending on a number of factors, primarily the investor's investment and risk-taking criteria, and his or her entry and exit criteria for a particular security. To assist investment decisions, investors typically rely on a variety of information from different sources. The warnings generated from a system such as Cassandra and its ability to anticipate trends will depend on aspects such as the quality of the data used and the accuracy of the machine learning models, but its effectiveness will also be affected by various macro factors, such as the volatility of financial markets, or possible atypical events at a global or local level. Cassandra provides predictions based on historical analysis and patterns, but it is important to note that any investment decisions are made solely by the user, and therefore Cassandra assumes no responsibility for any outcome of the user's investment or other decisions, which are solely the responsibility of the user.

The accuracy of Cassandra's forecasts can be affected by a number of factors, such as data quality, the stability of financial markets and the unpredictable nature of future events. It is important to understand that no prediction can guarantee 100% accurate results. Cassandra uses advanced algorithms and techniques to provide predictions that are as accurate as possible, but there is always some margin of error.

Cassandra's forecasts can be used as a tool to support investment decisions. You can consider the forecasts as a relevant additional source of information when evaluating investment opportunities and designing your strategies. It is important to complement the forecasts with your own analysis, experience and understanding of the market.

We take rigorous measures to protect the security and privacy of user data. We implement security protocols and follow best practices to protect the information we collect. In addition, we comply with applicable privacy regulations and standards.

Cassandra is distinguished by its approach based on Artificial Intelligence and Machine Learning. It uses advanced algorithms and analyses a large volume of historical data to generate more accurate predictions. Currently, Cassandra focuses specifically on Bitcoin, providing a specialised solution for this crypto-asset.

Details on Cassandra's costs and subscription plans are available in our Plans and Pricing section. We offer different subscription options to suit the needs of different users. We invite you to consult that section for detailed information on pricing and features included in each plan.

No advanced technical or financial knowledge is required to use Cassandra. It is designed to be accessible to both professional/experienced investors and beginners. Full documentation and support is provided to help you get the most out of the system. On the other hand, it is highly recommended that before making any investment decision, the user is sufficiently educated about the financial markets, how they work, the different assets available, and the potential risks that will be taken. Specifically, it is advisable that before investing in any specific security, the user knows the relevant aspects about it and its current situation.

Cassandra regularly updates its forecasts based on newly available data and changes in the financial markets. The frequency of updates may vary depending on market conditions and other relevant factors. However, we work to provide up-to-date and relevant information to support your investment decisions.

No, in any case. We cannot offer guarantees of specific results or refunds, as investments are subject to inherent risks, which depend on the risk and/or technical criteria of each user. Cassandra's forecasts are decision support tools, but cannot predict the future with absolute certainty. We recommend that you use the forecasts in a complementary manner and make your own investment decisions in an informed manner.

Once you have registered with Cassandra (and selected a subscription plan), we will send you the relevant login information and you will be able to receive forecasts and analysis via the subscriber-specific Telegram channel. There you will find reports, charts and other resources to support your investment decisions.

Contact

Talk to us. We want to hear from you. Write to hi@cassandralab.ai,

or tell us what you want below: